Subrogation:

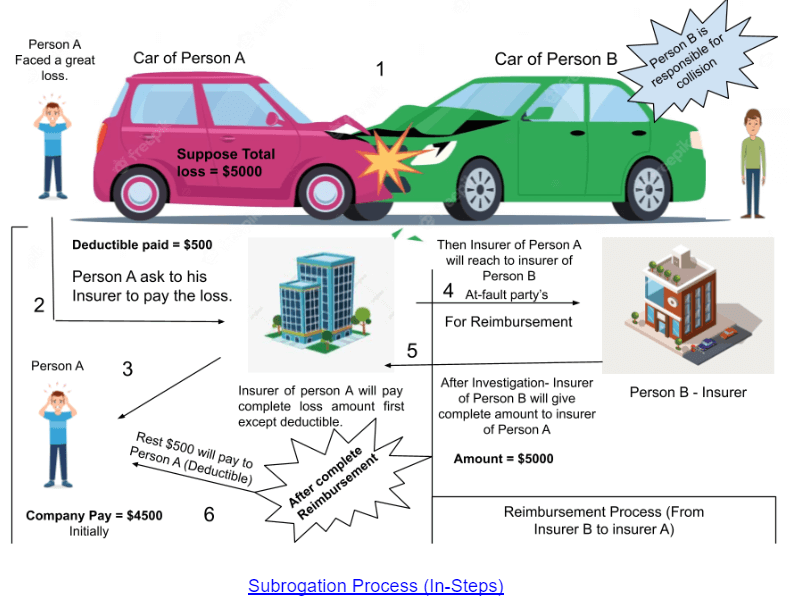

When an insurance company keeps a right to legally pursue a third party (who was at fault) that can cause a claim loss to the insured, this is called as subrogation.

Most of the time, an individual insurance company will pay the claim for the loss of their client, and then the insurance company of the insured will reach out to the insurance company of another party (who is mainly responsible for fault) to get the reimbursement for the insured’s claim.

The subrogation process allows the at-fault party’s insurer to reimburse the claim amount to the victim’s insurance company. So in the end the victim’s insurance company will pay the whole amount to the victim including deductibles.

For example,

Here in this process company of Person A has the right to reach out to the insurance company of person B to get the reimbursement for the insured’s claim.

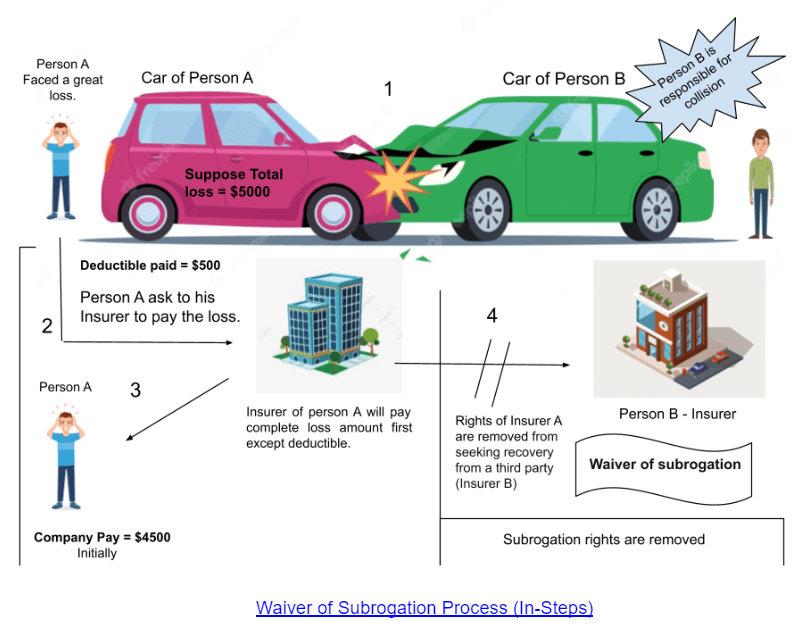

Waiver of subrogation

Waiver of Subrogation is a kind of provision, where an insured asks the insurer to waive off their right to seek reimbursement from a negligent third party so that the insured’s own claim could not go into risk in such a case. As a whole, we can say that waiver of subrogation can prevent the victim’s insurer from seeking recovery from the at-fault party’s insurer.

The insurance company will charge an additional fee from the Insured for a waiver of subrogation endorsement.

Note: Waiver of Subrogation is removing the right from the insurance company to perform the subrogation process.

Example:

Let’s take the same example with is given above for the Subrogation to understand the waiver of subrogation.

Benefits of Waiver of Subrogation:

Waiver of Subrogation may help to keep the working relationship on the friendly term instead of keeping this complicated with lawsuits. In most cases, this will help to avoid business conflicts.

Waiver of Subrogation in Worker’s Compensation policy:

It is important for an employer, to know why a waiver of subrogation is used in the worker’s compensation policy.

In this scenario, a waiver of subrogation is an agreement between two parties, by which one party called an employer agrees not to seek compensation from the other party for any worker’s compensation payout. So waiver is often used to develop a good relationship between the employer and third party.

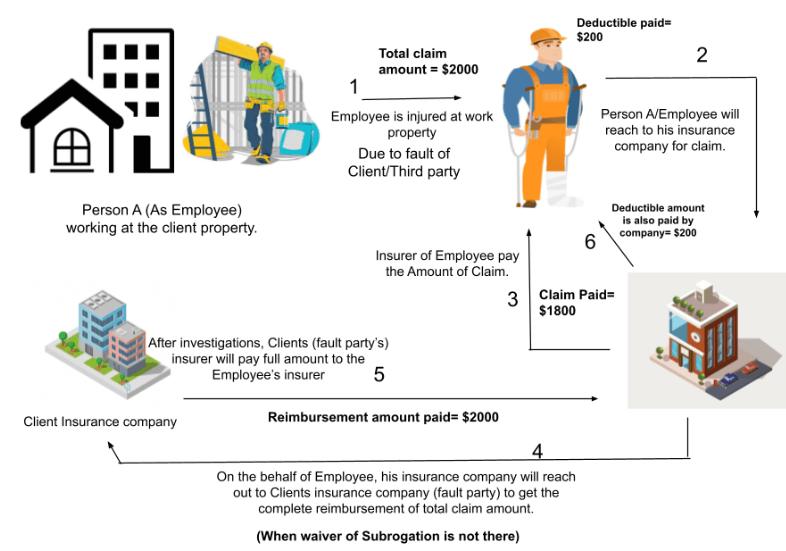

Let’s take an example to understand this flow of worker compensation:

So when a waiver of subrogation is not available there in the worker compensation policy, the claim process could be like this (for a particular scenario):

Suppose a client hires the employee from any subcontractors for their work. So person A could be an Employee sent by Subcontractor to work for the client.

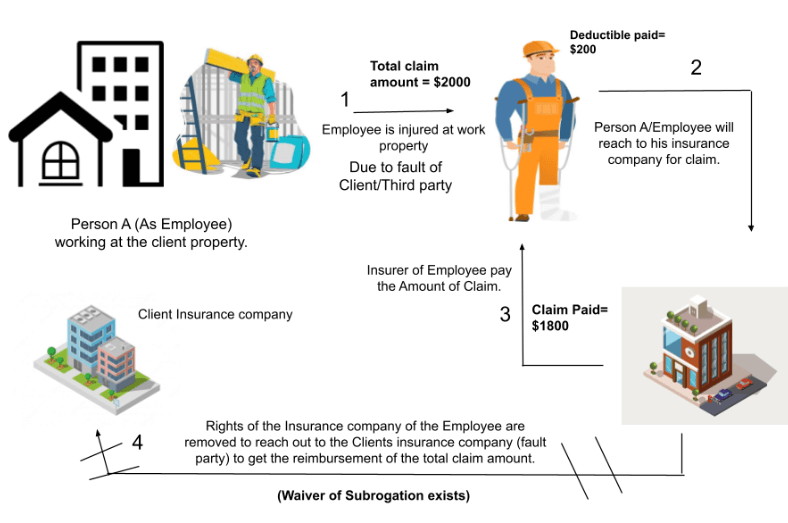

Then, in most cases, Clients would ask any business/ subcontractor to add a waiver of subrogation for them in their worker’s compensation policy while they ask to provide the Certificate of insurance for them as certificate holder. So this will remove the right of the employee’s Insurance company to seek reimbursement from a negligent third party/client.

Waiver of subrogation is mainly used in initial business contracts or agreements to reduce the risk of future conflicts.

Let’s take the same example when a waiver of subrogation is taken in a worker’s compensation policy.

Waiver of Subrogation on Certificate of Liability Insurance (ACORD 25):

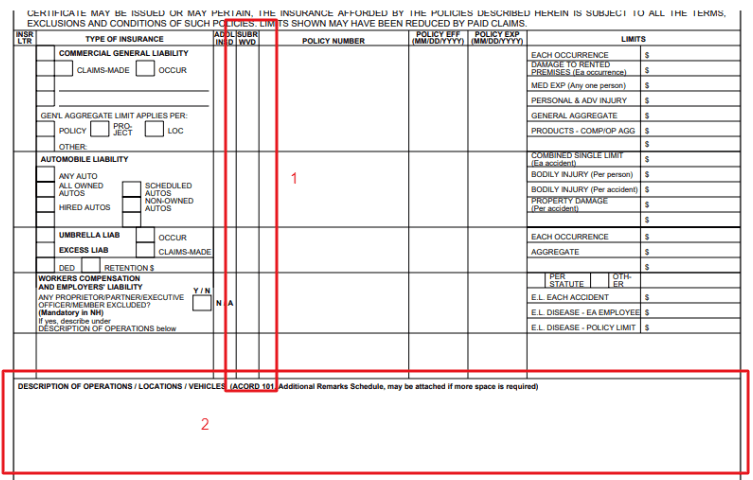

Over the certificate of liability insurance there are two places or we can say two elabels fields where we can mention the details about the Waiver of subrogation.

- Subr Wvd: In this field, a Yes or No response should be entered in the form of “Y” and “N” which indicates the subrogation has been waived in a particular policy.

- Description of Operations / Locations / Vehicles: This field will mainly contain additional information about the operations, locations, and vehicles for which the certificate was issued.

But this can also contain the details about the “Waiver of subrogation” for existing policies while needed. For example: if the “Type of Insurance – Workers Compensation and Employers’ Liability – Any Proprietor/Partner/Executive/Officer/Member Excluded?” field is marked as true (Checkbox contained “Y” as value) which is available in the worker’s compensation section of ACORD 25. Then the “DESCRIPTION OF OPERATIONS” remarks field is needed to be filled with further details.

References (You tube links):

https://www.youtube.com/watch?v=KpA45kjvX2Q

https://www.youtube.com/watch?v=N9FX4w2w4w0

https://www.youtube.com/watch?v=TDzry7OF5HM&t=57s

https://www.youtube.com/watch?v=hhn35ITQ_lw

https://www.youtube.com/watch?v=135-_1zenKc